does tesla model y qualify for federal tax credit

Explore Our Alt-Fuel Models Find Yours Today. The agency didnt.

Is The Tesla Model Y Really Worth 60 000 Will Orders Slow Down

So based on the date of your purchase TurboTax is correct stating that the credit is not available for your vehicle.

. Any vehicles purchased after that date are no longer eligible for the Federal credit due to the number of vehicles manufactured. GMC Hummer Pickup and SUV. Internal Revenue Code Section 179 Deduction allows you to expense up to 25000 on VehiclesOne year that are between 6000 Pounds and 14000 Pounds or More in the year they are placed in service.

2022 models that likely qualify for a tax credit under the Inflation Reduction Act. That should be fair sales for US buyers and from all auto manufactures sold in the US. When a manufacturer sells its 200.

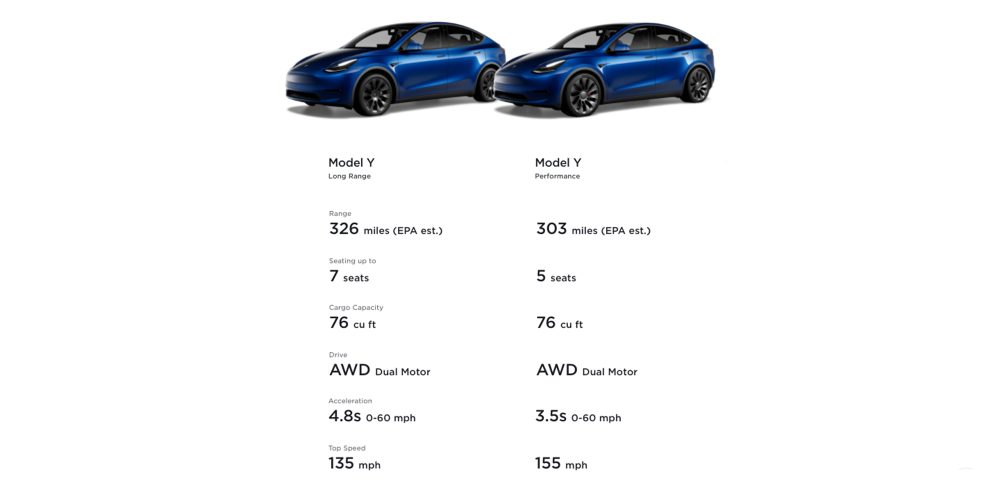

The Model 3s success in the automotive market is credited with Teslas leading position in the automaker. Jun 27 2019. Tesla Model Y 179 Deduction.

1 day agoStarting Jan. Local and Utility Incentives. 2 hours agoThe Model Y is one of Teslas best-selling cars but does it qualify for the 7500 federal tax credit.

That cap is lifted on January 1 2023 so cars tagged as manufacturer sales cap met will not qualify for the electric car tax credit until next year. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the. Based on the Model 3 sedan the Tesla Model Y is a battery electric compact crossover that was originally unveiled in 2019.

Ad Electric Efficiency With The Range Of Gas. Unfortunately Tesla vehicles are no longer eligible for this perk. If you act quickly the Ford Mustang Mach-E and Volkswagen ID4 are still eligible for the full credit.

If the bill is passed Tesla buyers could be eligible for the benefit. The law should give the EV industry a boost. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger.

Why is Teslas lineup no longer eligible and which manufacturers still receive tax credits. Bonus add a 5000 Tax credit for Level 5 FSD until. Since Tesla Model Y is less than 6000 pounds maximum section 179 deduction for Model Y is 10100.

According to Electrek the Tesla Model Y Long Range is 9000 more than it was at the start of 2021. Aspiring Tesla owners should pay close attention. The tax credit would be available only to couples with incomes of 300000 or less or single people with income of 150000 or less.

It wont however apply to some of the most popular EVs. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. Since its launch it has gone on to become a smash hit with consumers with Elon Musk recently claiming that it is on track to become the.

The Tesla Model 3 Tesla Model Y and Chevy Bolt are no longer eligible for credits under the current tax scheme which phases out tax credits after an automaker sells 200000 EVs. One of the incentives for buying an electric vehicle is the federal tax credit. The price caps for.

Lets hope they approve an extended Federal Tax credit of 7500 for all until a date such as 2024. TSLA or Tesla buyer will qualify for a tax credit. If youre wondering why no Teslas or the GMC Hummer EV are included its because GM and Tesla vehicles are no longer eligible for the federal tax credit.

1 2023 more caveats come into effect. Nonetheless analysts predict Tesla should qualify for the new tax credit with the Model Y crossover the bestselling EV in the US based on new-vehicle registrations this year through June. Tesla and other EV buyers could soon be eligible for 7500 federal tax credits under Senate deal.

Buyers of Tesla and other. The Plug-in Electric Drive Motor Vehicle Credit electric car tax credit is a short-term incentive to offset the initial higher purchase price of qualified vehicles. Sedans have to be under 55000 to qualify and the cost of trucks vans and sports utility vehicles cant exceed 80000.

Currently Teslas are not eligible for any federal EV tax credits but they qualify for state tax incentives. Then require only new zero emission autos sold after 2050. So now you should know if your vehicle does in fact qualify for a federal tax credit and how much you might be able to save.

Still not every Tesla ticker. 1 day agoThe bill retains the 7500 maximum tax credit but scraps the 200000-unit production limit that GM and Tesla hit long ago and which was about to affect other brands like Toyota and Ford. Compare Specs Of Hyundais Alt-Fuel Vehicles Like The IONIQ 5 NEXO Fuel Cell More.

TESLA does not qualify until 1123 Model 3 2022 7500. About 20 model year 2022 and early model year 2023 vehicles will still make the cut for EV tax credits of up to 7500 through the end of the year. And any trucks or SUVs with sticker prices above 80000 or.

Electric Vehicles Solar and Energy Storage. Until now buyers of electric cars and plug-in hybrids could get up to a 7500 federal tax credit as long as the manufacturer hasnt sold more than 200000 qualifying vehicles. And Tesla Model 3 Model S Model X and Model Y vehicles.

3750 for tax years 2025-26. The Tesla Model 3 is one of the worlds best-selling electric vehicles but does it qualify for a federal tax creditThe Model 3 expertly blends performance with affordability with range and Autopilot an advanced driver safety system among the cars selling points. This federal tax credit ranges from 2500 to 7500 for qualified electric vehicles that draw energy from a battery.

The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019.

Tesla Adds Lower Priced Model Y Standard Range At Last The Car Guide

Tesla Model 3 Vs Model Y The Latest Generation Basics Compared Electrek

2023 Tesla Model Y Specs And Features For The Best Selling Ev

Tesla Adds Lower Priced Model Y Standard Range At Last The Car Guide

2021 Tesla Model Y Review Autotrader

Why You Should And Shouldn T Buy The Tesla Model Y

2021 Tesla Model Y Prices Reviews And Pictures Edmunds

Tesla Model Y Car Insurance Cost Forbes Advisor

Standard Range Tesla Model Y Officially Added To Cev For Bc Rebate List Of Eligible Vehicles Drive Tesla

Tesla Adds Lower Priced Model Y Standard Range At Last The Car Guide

2021 Tesla Model Y Prices Reviews And Pictures Edmunds

Tesla Hikes Price Of Model 3 Model Y By 2 000

Why You Should And Shouldn T Buy The Tesla Model Y

Tesla Model Y Price Goes Up Could Ev Tax Credits Be The Reason

Tesla No Longer Eligible For California Rebate Due To Price Increases

Tesla Increases Price Of Model Y In Canada Delays Expected Delivery Date

Tesla Drastically Accelerates Model Y Delivery Timeline What Is Happening Tesla Acceleration Tesla Update